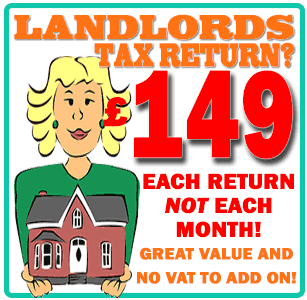

Landlord Tax Return

Ready for us to calculate and file your Landlord tax return? Click here

Landlord Tax Return; Landlords are subject to various taxes related to their rental income and property ownership. The key taxes that landlords need to be aware of include:

Are you looking for a different kind of tax service? click here for a reminder of all the different services we offer clients.

Ready for us to calculate and file your tax return? Lets Go!

Your personal details

We need a few details about you, please make sure these match with the details HMRC expect, for example if you recently got married, please let us have your maiden surname unless you have already made HMRC aware of the change.

Tax References

If you are not resident in the U.K. you may not have a NI / National Insurance number, in which case leave this field empty. Your UTR is received from HMRC once you inform them you have income from sources other than regular emplopyment. If you do not have your UTR, please leave it empty for the moment, we will assist you to receive your requiured reference.

Employment information

Have you been employed in this tax year? If you are employed, you will probably have paid tax on each wage slip, we need to take this into account, you may be due a rebate!

Self-employment information

Please tell us about your income and expenses for self-employment

Additional income

Here are some additional sources of taxable income you may need to tell us about

Your Details

Tax References

If you are not a resident of the United Kingdom, you may not have a valid U.K. national insurance number, in which case please leave it blank.

Your UTR should be included on any letters you receive from HMRC, sometimes called a Tax Reference. It is a 10 digit numeric reference given to you when you are first registered for self assessment taxation. If you do not have it to hand, please leave this question blank.

Employment Income

Employment P60's (you can select multiple files if needed)

Max. size: 192.0 MB

If you do not have your employment P60(s) to upload, you can upload wage slips, or complete the details below.

Self employed income

Self employed expenses - We do not require receipts for your purchases/expenses, however you should always keep them on hand for at least 6 years. Some of these expense questions may not apply to your business, please leave them blank, however if there is something you need to include that just does not fit elesewhere, please include in the final entry

Additional sources of income and expenditure

If you have forms of income which you feel you may need to declare to HMRC, please do let us have the details below. If you are not required to pay tax on the income, we will not include it on your tax return submission.