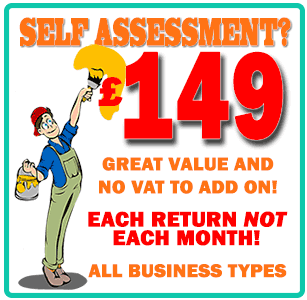

Self assessment tax

Ready for us to calculate and file your self assessment tax return? Click here

Ready for us to calculate and file your self assessment tax return? Click here

Self-assessment tax refers to a system where individuals, trustees, and businesses assess their own tax liability and report it to the tax authority, rather than having it automatically deducted by an employer or other third party.

Self-assessment tax refers to a system where individuals, trustees, and businesses assess their own tax liability and report it to the tax authority, rather than having it automatically deducted by an employer or other third party.

Here’s how it generally works:

- Assessment: Taxpayers are responsible for assessing their own tax liability. This involves calculating the total amount of income they’ve received during a tax year, deducting any allowable expenses or reliefs, and determining the amount of tax owed.

- Tax Returns: Taxpayers are required to complete a tax return form, detailing their income, expenses, and reliefs for the relevant tax year. This form is usually submitted to the tax authority by a specific deadline.

- Payment: Along with the tax return, taxpayers typically need to pay any tax owed to the tax authority. Payment is usually made electronically or by mail, following the instructions provided by the tax authority.

- Deadlines: There are strict deadlines for filing tax returns and making tax payments. Missing these deadlines may result in penalties and interest charges.

- Records: Taxpayers are required to keep accurate records of their income, expenses, and any other relevant financial transactions. These records may be requested by the tax authority for verification purposes.

The self-assessment tax system is administered by Her Majesty’s Revenue and Customs (HMRC). Taxpayers are required to register for self-assessment if they meet certain criteria, such as being self-employed, earning rental income, or having income from investments. They must then submit their tax returns and any associated payments by the relevant deadlines, usually by January 31st following the end of the tax year for online submissions, and by October 31st for paper submissions.

Overall, self-assessment tax puts the onus on taxpayers to accurately report their income and pay the correct amount of tax, ensuring compliance with tax laws and regulations. You can find out more about self-assessment tax from HMRC directly here https://www.gov.uk/government/collections/self-assessment-detailed-information

Are you looking for a different kind of tax service? click here for a reminder of all the different services we offer clients.

Feeling lost? Need to know if self assessment is the best fit for you?

Click here and we will put you in touch with one of our accountants.

Ready for us to calculate and file your tax return? Lets Go!

Your personal details

We need a few details about you, please make sure these match with the details HMRC expect, for example if you recently got married, please let us have your maiden surname unless you have already made HMRC aware of the change.

Tax References

If you are not resident in the U.K. you may not have a NI / National Insurance number, in which case leave this field empty. Your UTR is received from HMRC once you inform them you have income from sources other than regular emplopyment. If you do not have your UTR, please leave it empty for the moment, we will assist you to receive your requiured reference.

Employment information

Have you been employed in this tax year? If you are employed, you will probably have paid tax on each wage slip, we need to take this into account, you may be due a rebate!

Self-employment information

Please tell us about your income and expenses for self-employment

Additional income

Here are some additional sources of taxable income you may need to tell us about

Your Details

Tax References

If you are not a resident of the United Kingdom, you may not have a valid U.K. national insurance number, in which case please leave it blank.

Your UTR should be included on any letters you receive from HMRC, sometimes called a Tax Reference. It is a 10 digit numeric reference given to you when you are first registered for self assessment taxation. If you do not have it to hand, please leave this question blank.

Employment Income

Employment P60's (you can select multiple files if needed)

Max. size: 192.0 MB

If you do not have your employment P60(s) to upload, you can upload wage slips, or complete the details below.

Self employed income

Self employed expenses - We do not require receipts for your purchases/expenses, however you should always keep them on hand for at least 6 years. Some of these expense questions may not apply to your business, please leave them blank, however if there is something you need to include that just does not fit elesewhere, please include in the final entry

Additional sources of income and expenditure

If you have forms of income which you feel you may need to declare to HMRC, please do let us have the details below. If you are not required to pay tax on the income, we will not include it on your tax return submission.

Miscellaneous Information

Rebates are always affected by your earnings, expenses and other personal circumstances. When you send us information, it's important it is correct, we can make changes to your tax calculation however we may charge an additional admin fee. We are happy to complete capital gain calculations for you, however they are not included in the standard self-assessment return service. We include two sections of the self-assessment return within the standard price, additional sections where required attract an additional fee of £25 + VAT per section. Our self-assessment charges become payable when we create your tax return calculation, submission to HMRC is included without additional charge. We are of course unable to guarantee a tax refund if your expenses and earnings declared do not allow for a rebate.